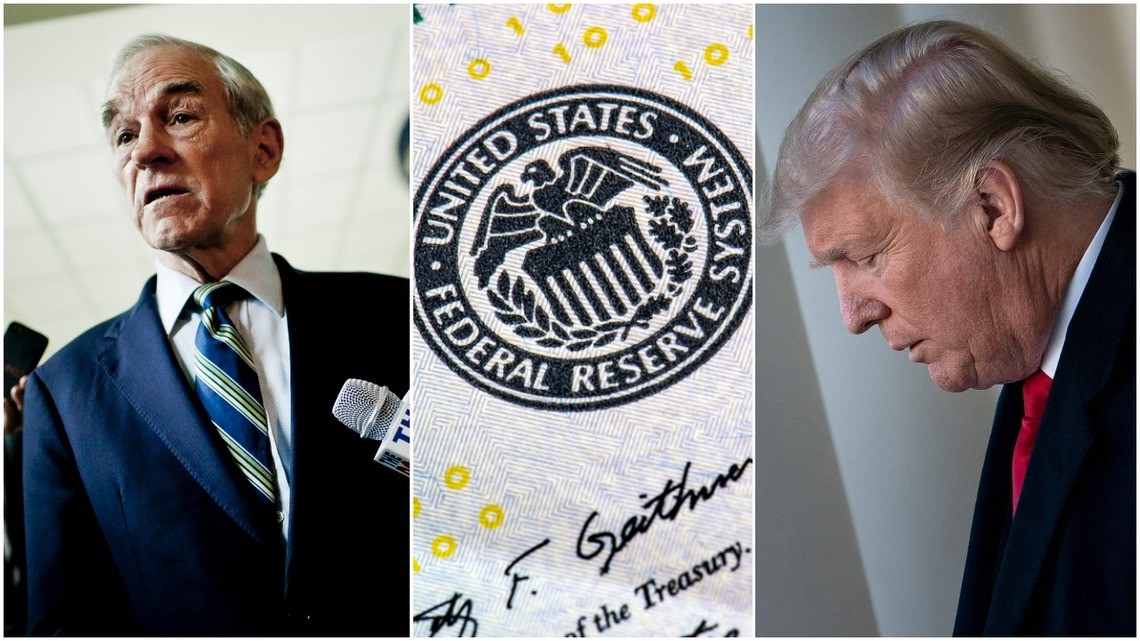

Ron Paul, the pro-bitcoin retired U.S. Congressman, says President Donald Trump is correct when he says the Federal Reserve is clueless and useless. Moreover, Paul says the Fed should stop manipulating interest rates because that fuels artificial bubbles and stock market crashes.

Rand Paul: The Fed Does More Harm than Good

In a blistering July 19 Fox Business column, the father of Senator Rand Paul says Trump should curb the unfettered power of the Fed to roil the financial markets.

“President Trump is right – the Fed doesn’t know what it is doing. But it is up to him to stop it from further increasing in power. For over a century, the central bank has inadvertently caused rampant inflation, economic recessions, and even wealth inequality.”

Paul blamed the Federal Reserve’s artificial manipulation of interest rates for causing recessions and a shocking 95% plunge in Americans’ buying power.

“The only thing the Fed is good at is making life hard on the middle class by inflating consumer prices. Consumer Price Index inflation in the pre-Fed years of 1790-1912 was just 0.22%. But between 1913-2013, it skyrocketed to 3.35%. So much for its goal of stabilizing prices.”

Paul: Trump Must Check the Fed’s Power

Paul — a Libertarian and frequent critic of Trump — credited Trump for spotlighting the Fed’s rank incompetence. But Paul say it’s not enough just to call out the Fed for its screw-ups. He says Trump must stem the central bank’s power to cause more damage.

“Will Trump stop the Fed from doing even more harm to the American economy by preventing it from extending its tentacles into other parts of the U.S. financial system?”

Fmr. Texas Congressman Ron Paul says he's all for crypto and blockchain.

— Squawk Alley (@SquawkAlley) July 15, 2019

"I'm for the least amount of regulation and I think cryptocurrencies are a great idea. Just one rule: no fraud!" @CNBC @carlquintanilla @MorganLBrennan @jonfortt pic.twitter.com/VRhGOfQebM