Bitcoin is back!

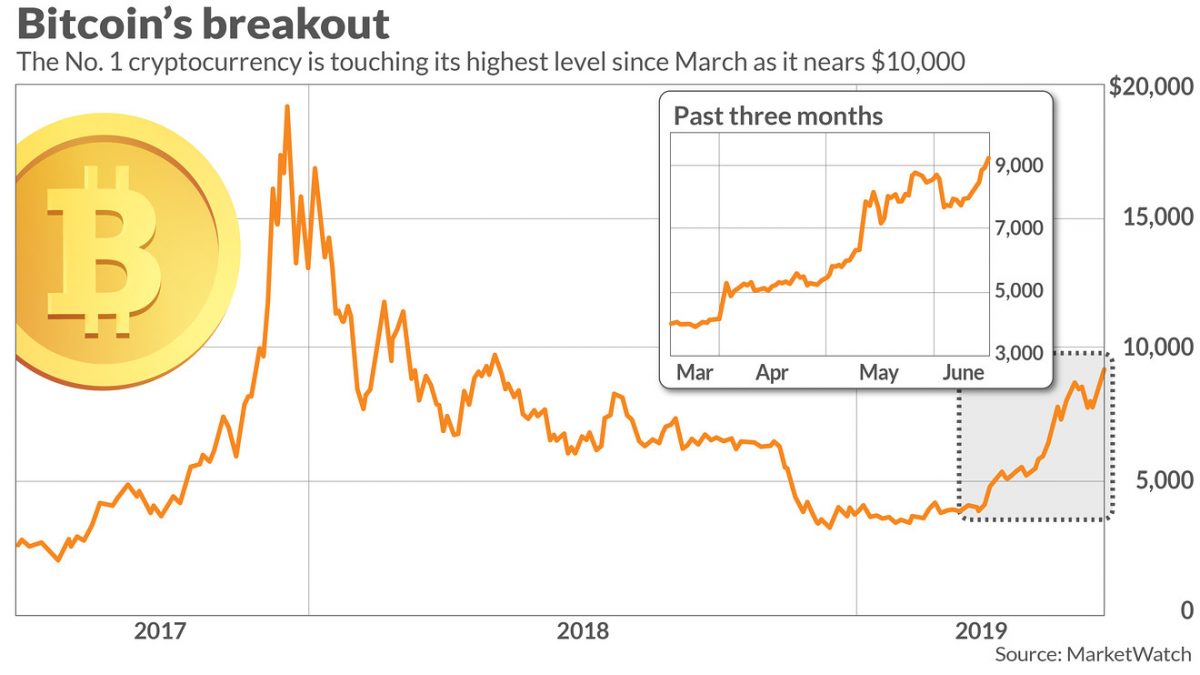

The world’s No. 1 cryptocurrency is on fire, with a price approaching $10,000, pushing the digital asset near its highest level in more than 14 months, according to MarketWatch data provided by CoinDesk.

A single bitcoin BTCUSD, +0.49% most recently, was trading at $9, 218.21, after putting in a December low at $3,194.96. Its current level is bitcoin’s loftiest level since March 29, 2018 when a bitcoin changed hands above $9,700.

Moreover, bitcoin trading on the CME Group’s futures exchange for June deliveryBTCM19, +0.64% was at $9,265, up 9.7% on the day, representing a 153% surge for bitcoin futures for the year to date.

This compares with a gain of 12% for the Dow Jones Industrial AverageDJIA, +0.09% a 15% advance for the S&P 500 index SPX, +0.09% and a more than 18.3% return for the Nasdaq Composite Index COMP, +0.62% according to FactSet data.

Here are a few theories about why bitcoin has been zooming higher lately:

Institutions not individual investors are bullish

Wall Street has taken a hard look at cryptocurrencies and the digital-ledger technology that underpins most assets, blockchain, and has decided to take a chance.

JPMorgan Chase & Co. JPM, -0.55% led by one of bitcoin’s more outspoken critics, announced in February JPM Coin, designed as a way to handle digital settlements. A number of other banks, including UBS Group, have also announced efforts to use blockchain to assist in international settlements.

Michael Moro, ceo of Genesis Global Trading, an OTC digital currency trading firm, told MarketWatch via email:

“The first time Bitcoin crossed the $9,000 mark was in November 2017. That price movement was largely driven by international retail demand – South Korea, for example – in addition to hype around initial coin offerings. This time around, however, we believe that institutional money is playing a much bigger role than it did in 2017, which is evidenced by CME’s record of futures volumes.”

Growing interest

Trading of bitcoin has been climbing, as reflected in futures activity on CME Group. Over the past several weeks bitcoin futures trading activity, gauged by its moving average since inception of bitcoin trading is at a record (see chart below). Trading on the CME made its debut in late December, while another futures platform Cboe Futures Exchange, which kicked of bitcoin trading on Dec. 17, will see its June contract XBTM19, +2.67% mark the end of its foray into bitcoin futures.

Facebook’s libra

Reports that Facebook Inc. FB, +1.15% is about to roll out a cryptocurrency as soon as Tuesday has helped bitcoin to notch its best weekly trading period in about three weeks.

The social-media giant will unveil a new crypto-payment platform that could facilitate digital payments not just on Facebook’s site but anywhere on the internet. Participants reportedly include an array of heavyweight backers, like Mastercard Inc. MA, -0.35% PayPal Holdings Inc. PYPL, +0.85%UberTechnologies UBER, +1.27% and Visa Inc. V, -0.06%

Check out: ‘If you’re not a billionaire’ in 10 years ‘it’s your own fault,’ says 20-year-old bitcoin tycoon

Ripple effect?

Shares of MoneyGram International Inc. MGI, +153.79% soared late-Mondayafter Ripple Inc., a blockchain startup behind the XRP coin XRPUSD, -1.48%agreed to invest up to $50 million in the money-transfer company, marking another powerful event for cyptos.

Via marketwatch.com